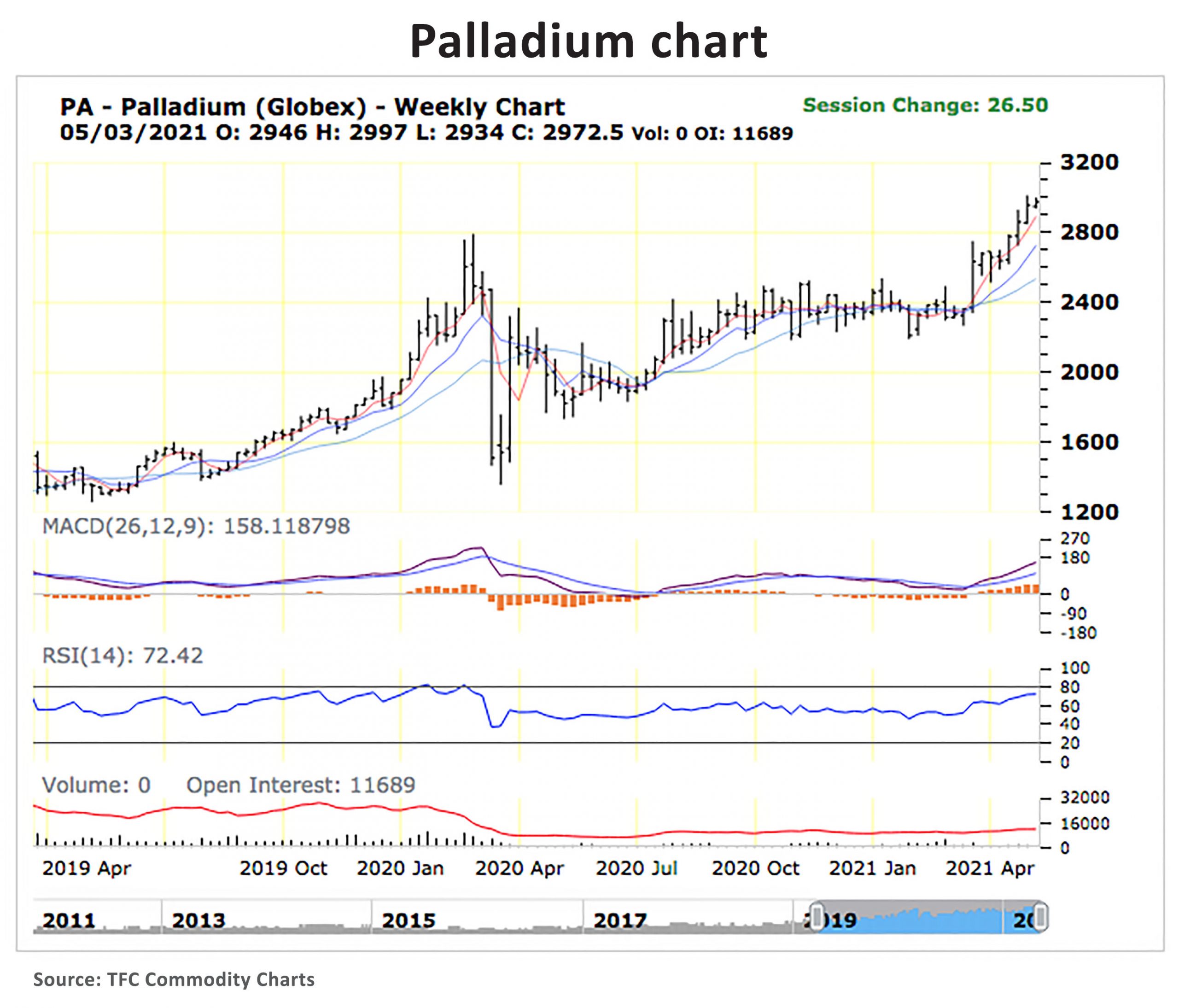

If you use palladium in your lab, you’ve likely noticed that the price of palladium has been climbing rapidly over the past few months. You may be wondering what is behind the high prices, and will it ease up this year?

As some of you may recall from our last post on palladium back in February 2018 (https://corarefining.com/why-is-palladium-so-expensive-and-will-it-keep-going-up/), supply was tight due to high demand from the automotive industry. As of the spring of 2021, that situation has not improved that much, despite a global pandemic.

Palladium was briefly affected by the pandemic in the spring of 2020 when there was a sharp decline in demand for cars. The 41% drop brought the price of palladium down from $2614 per ounce to $1522 per ounce. However, that drop was short-lived as the automotive industry went through a V-shaped recovery, and the demand for palladium bounced right back.

You may also recall in 2018, that experts were predicting that automakers would begin to switch over to using the more affordable precious metal, platinum, in their catalytic converters to keep their costs low. However, that change has not happened yet as of the writing of this post.

The median price forecasted for palladium this year by 26 analysts and traders, was $1700 – $2000. Right now, it’s well past that price forecast. What happened?

The Palladium Shortage

The 10 million ounce per year palladium market will be undersupplied for the 10th year in a row. In 2020, there was a shortage of 883,000 oz. In 2021, analysts are predicting a 727,000 oz. shortage. So there will be less of a shortage, but still a significant shortage nonetheless.

What caused the most recent run-up in prices?

Besides the renewed focus on reducing vehicle emissions and the ongoing shortage, there were power outages at a top palladium producer in South Africa that appears to have played a role in the recent run-up in prices to over $2500.

Other factors include Covid restrictions at the South African mines, which have limited palladium output. In addition, investors looking for a safe haven during times of easy monetary and fiscal policy are also playing a role in the sharp price increase.

The Wild Card: Electric cars

Electric cars don’t use palladium. If the world begins to embrace electric cars, the demand for palladium should decrease as 80% of palladium demand comes from the auto industry.

While we don’t make forecasts about the precious metals markets, we do try to provide as much information as possible to our clients so they can make knowledgeable decisions on when to send in their dental scrap. We hope this post has helped and we encourage our clients to keep up on the latest events affecting gold and palladium prices.